Introduction

This document details the methodology for the revised Total Per Capita Cost (TPCC) measure. The methodology should be reviewed along with the Measure Codes List file, which contains the medical codes used in constructing the measure.

Measure Description

The revised TPCC measures the overall cost of care delivered to a beneficiary with a focus on the primary care they receive from their provider(s). The measure is a payment-standardized, risk-adjusted, and specialty-adjusted measure. The revised measure is attributed to clinicians, who are identified by their unique Taxpayer Identification Number and National Provider Identifier pair (TIN-NPI) and clinician groups, identified by their TIN number. The revised TPCC measure can be attributed at the TIN or TIN-NPI level.

Stay up to date with the latest news regarding MACRA and MIPS.

Measure Rationale

The TPCC measure is an important means of measuring Medicare spending, as health expenditures continue to increase in the United States. Total health care spending is estimated to have increased by 4.6 percent in 2017, reaching $3.5 trillion.2 Spending for Medicare, which is still predominantly paid on a fee-for-service (FFS) basis, grew by 3.6 percent, reaching $672.1 billion. Spending on services for physicians and other health professionals totaled $69.9 billion and accounted for 15 percent of Medicare FFS spending in 2016. The revised TPCC measure specifically focuses on the importance of successful payment models for primary care management. Effective primary care management can support Medicare savings in a number of ways, including through improvements in the treatment of chronic conditions by obviating the need for high-cost hospital or emergency department services. More effective primary care management can also direct a greater proportion of patients to lower hospital costs for the inpatient services. Given the potential for decreasing spending through improvements in primary care delivery, the TPCC measure allows for a savings opportunity by capturing the broader healthcare costs influenced by primary care.

A TPCC measure was originally used in the Physician Value-Based Payment Modifier (VM) Program and reported in the annual Quality and Resource Use Reports (QRURs). With the introduction of the Quality Payment Program, the current TPCC was finalized with minor adaptations from VM and added to MIPS. Subsequent Final Rules have noted that current TPCC and MSPB measures would be refined based on stakeholder input.

A technical expert panel (TEP) provided high-level guidance for the refinement of the measure at meetings in August 2017 and May 2018. The TEP consisted of 19 members from diverse backgrounds, including clinicians, healthcare providers, academia, and patient advocacy organizations. The revised TPCC measure underwent Field Testing in October-November 2018. A public comment period accompanied Field Testing, during which stakeholders reviewed and provided feedback on the TPCC Field Test Reports and the publicly posted supplementary documentation. Following Field Testing, the TEP reconvened in November 2018 to guide further measure refinement to address stakeholder feedback received through the public comment period.

Beneficiary Exclusion Criteria

Beneficiaries are excluded from the measure population if they meet any of the following conditions:

- They were not enrolled in both Medicare Part A and Part B for every month during the measurement period, unless part year enrollment was the result of new enrollment or death.

- They were enrolled in a private Medicare health plan (e.g., a Medicare Advantage or a Medicare private FFS plan) for any month during the measurement period.

- They resided outside the United States or its territories during any month of the measurement period.

- They are covered by the Railroad Retirement Board.

Measure Numerator:

The numerator for the measure is the sum of the risk-adjusted, payment-standardized, and specialty-adjusted Medicare Parts A and B costs across all beneficiary months attributed to a TIN or TIN-NPI during the measurement period.

Measure Denominator:

The denominator for the measure is the number of beneficiary months attributed to a TIN or TIN-NPI during the measurement period.

Data Sources

The revised TPCC measure uses the following data sources:

- Medicare Parts A and B claims data from the Common Working File (CWF),

- Enrollment Data Base (EDB),

- Common Medicare Environment (CME),

- Long Term Care Minimum Data Set (LTC MDS), and

- Provider Enrollment, Chain, and Ownership System (PECOS).

Quick Reference: Methodology Steps

There are two overarching processes in calculating revised MSPB clinician measure scores: episode construction (Steps 1-3) and measure calculation (Steps 4-6). This section provides a brief summary of these processes, and Section 4.0 describes them in detail.

- Identify candidate events. A candidate event identifies the start of a primary care relationship between a clinican and beneficiary. A candidate event is defined using select evaluation and management (E&M) CPT/HCPCS codes for outpatient physician visit, termed E&M primary care service, paired with one or more additional service(s) indicative of general primary care that together trigger the opening of a risk window.

- Apply service category and specialty exclusions. Clinicians are excluded from attribution if they meet the criteria for one or more service exclusions in the following categories: global surgery, anesthesia, therapeutic radiation, and chemotherapy. Clinicians are also excluded based on their HCFA Specialty designation, if they identify as one or more of the 56 specialties in the specialty exclusion list.

- Construct risk windows. The risk window begins on the date of the candidate event and continues until one year after that date. A beneficiary’s costs are attributable to a clinician during months where the risk window and measurement period overlap.

- Attribute months to TINs and TIN-NPIs. After service category and specialty exclusions are applied, all beneficiary costs occurring during the covered months are attributed to the remaining eligible TINs. For TIN-NPI attribution, only the TIN-NPI responsible for the majority share, or plurality, of candidate events provided to the beneficiary within the TIN is attributed that beneficiary’s costs for their respective candidate events.

- Calculate payment-standardized monthly observed costs. Monthly observed costs are payment standardized to account for differences in Medicare payments for the same service(s) across Medicare providers. All standardized cost from services starting in a beneficiary month are assigned.

- Calculate risk-adjusted monthly costs. Risk adjustment accounts for beneficiary-level risk factors that can affect medical costs, regardless of the care provided. After costs are risk- adjusted, winsorization is applied to reduce the effect of outliers.

- Apply specialty adjustment to risk-adjusted costs. A specialty adjustment is applied to monthly risk-adjusted costs to account for the fact that costs vary across specialties and across TINs with varying specialty compositions.

- Calculate the measure score. Calculate the average payment-standardized, risk-adjusted, and specialty-adjusted monthly costs across all beneficiary months in the measurement period attributed to a TIN or TIN-NPI for the measure score.

Quick Reference: Specifications

This page provides a quick, at-a-glance reference for the revised TPCC measure specifications. The full list of codes and logic used to define each component can be found within the Measure Codes List file.

| Candidate Event: Which patients are included in the measure? | |

| A candidate event is defined as a pair of services billed by the clinician to the beneficiary within a short period of time. A candidate event marks the start of a primary care relationship between a beneficiary and a clinician. | |

| Risk Window: When is a clinician responsible for the beneficiary costs? | |

| Risk window is a year-long period that begins on the date of the candidate event. | |

| Beneficiary Months Attribution: How is the revised TPCC measure attributed? | |

| The measurement period is a static calendar year that is divided into 13 four-week blocks called beneficiary months. Beneficiary months that occur during a risk window and the measurement period are counted towards a clinician’s (clinician group’s) measure scores. These beneficiary months are attributed to the TIN billing the initial E&M primary care service. For TIN-NPI-level attribution, only the TIN-NPI responsible for the plurality (largest share) of candidate events provided to the beneficiary within the TIN is attributed the beneficiary months. | |

| Service Assignment: Which services are included in the measure? | |

| Revised TPCC is an all-cost measure. | |

| Risk Adjustors: How does TPCC adjust for beneficiary-level risk factors that can affect medical costs? | Exclusions: Which populations are excluded from the measure? |

| Beneficiary risk score is calculated using CMS-ESRD V21 models (Dialysis New Enrollee Model, Dialysis Community Model) and CMS-HCC V22 models (New Enrollee Model, Community Model, Institutional Model) Risk adjustors included in the CMS-HCC risk adjustment models include the following:

|

|

Detailed Measure Calculation Methodology

This section describes the construction of the revised TPCC measure in more detail: Section 4.1 outlines the construction and attribution of beneficiary months to clinicians and Section 4.2 outlines measure calculation.

Measure Attribution

This section outlines in detail the following steps in measure attribution:

Step 1: Identify Candidate Events

Step 2: Apply Service Category and Specialty Exclusions

Step 3: Construct Risk Windows

Step 4: Attribute Beneficiary Months to TINs and TIN-NPIs

Step 1: Identify Candidate Events

A candidate event is used to indicate the start of a primary care relationship between a clinician and beneficiary and is identified by the occurrence of two Part B Physician/Supplier (Carrier) claims with particular CPT/HCPCS services billed in close proximity. There are two different sets of CPT/HCPCS codes used: E&M primary care services and primary care services.

E&M primary care services are a specific set of evaluation and management codes for physician visits in the outpatient setting, physician office, nursing facility, or assisted living.

Primary care services are a broader list of services related to routine primary care and generally fall into the following categories:

- Durable Medical Equipment (DME) and Supplies

- Electrocardiogram

- Laboratory – Chemistry and Hematology

- Other Diagnostic Procedures (Interview, Evaluation, Consultation)

- Other Diagnostic Radiology and Related Techniques

- Prophylactic Vaccinations and Inoculations

- Routine Chest X-ray

- Clinical Labs

- Preventive Services

To identify a candidate event, firstly, an initial E&M primary care service billed on Part B Physician/Supplier (Carrier) claim is identified. This E&M primary care service is not considered if it occurs during a beneficiary’s stay at a Critical Access Hospital (CAH), Inpatient Facility, or Skilled Nursing Facility (SNF). Secondly, in addition to the initial E&M primary care service, at least one of the following services should be billed to confirm the candidate event:

- From any TIN within +/- 3 days: Another primary care service,

- From the same TIN within + 90 days: A second E&M primary care service OR another primary care service

See the “Prim_Care_E&Ms” and the “Prim_Care_Services” tabs of the revised TPCC Measure Codes List file for the list of the Current Procedural Terminology/Healthcare Common Procedure Coding System (CPT/HCPCS) codes that identify E&M primary care services and primary care services, respectively.

Step 2: Apply Service Category and Specialty Exclusions

Once candidate events are identified, TIN-NPIs can be attributed based on their involvement in the candidate event. The TIN-NPI responsible for a candidate event is found on the initial E&M primary care service claim of the candidate event. Some TIN-NPIs are excluded from attribution if they meet one of two types of exclusions: service category exclusions and specialty exclusions. Candidate events belonging to TIN-NPIs who meet any of these exclusions are removed from attribution and measure calculation for both the TIN-NPI and their respective TIN.

Step 2.1: Exclude Clinicians Based on Service Category Exclusions

A TIN-NPI and their candidate events are removed from attribution if a clinician met any of the following four service category thresholds for the same beneficiary:

- At least 15 percent of the clinician’s candidate events are comprised of 10-day or 90-day global surgery services.

- At least 5 percent of the clinician’s candidate events are comprised of anesthesia services.

- At least 5 percent of the clinician’s candidate events are comprised of therapeutic radiation services.

- At least 10 percent of the clinician’s candidate events are comprised of chemotherapy services.

The list of CPT/HCPCS codes used for each of the service exclusions can be found in the tabs of the TPCC Measure Codes List file labelled: “HCPCS_Surgery,” “HCPCS_Anesthesia,” “HCPCS_Ther_Rad,” and “HCPCS_Chemo.”

Step 2.2: Exclude Clinicians Based on Specialty Exclusions

After service category exclusions are applied, clinicians who would not reasonably be responsible for providing primary care are excluded from attribution of the revised TPCC measure. This exclusion aims to keep primary care specialists and internal medicine sub-specialists who frequently manage patients with chronic conditions falling in their areas of specialty. The excluded specialties list contains 56 specialties that fall into the following broad categories:

- Surgical sub-specialties

- Non-physicians without chronic management of significant medical conditions

- Internal medicine sub-specialties with additional highly procedural sub-specialization

- Internal medicine specialties that practice primarily inpatient care without chronic care management

- Pediatricians who do not typically practice adult medicine

The list of HCFA Specialty codes that identify clinicians that are included or excluded from the measure attribution can be found in the “Eligible_Clinicians” tab of the TPCC Measure Codes List.

As with service category exclusions described in Step 2.1, candidate events for clinicians in excluded specialties are removed from attribution and measure calculation for both the TIN-NPI and their respective TIN.

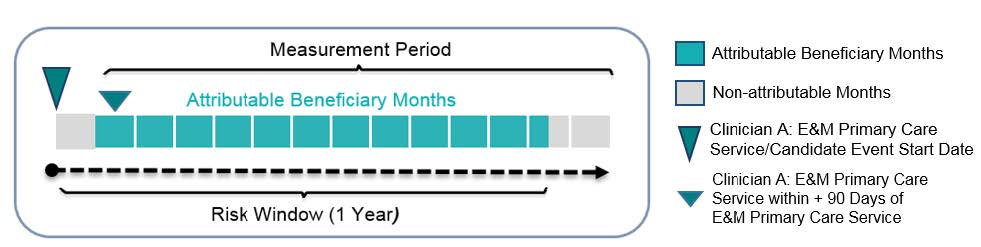

Step 3: Construct Risk Windows

Candidate events that are not excluded initiate the opening of a risk window, a year-long period that begins on the date of the initial E&M primary care service of the candidate event. The measurement period is divided into 13 four-week blocks called beneficiary months. Beneficiary months during the risk window are considered attributable if they occur during the measurement period. In the event that a risk window begins or ends with a partially covered month, only the portion during the risk window and the measurement period is considered for attribution. Appendix C contains examples of overlapping risk windows initiated by one or multiple TINs for the same beneficiary and explains how this overlap is addressed.

Step 4: Attribute Beneficiary Months to TINs and TIN-NPIs

Beneficiary months for a single beneficiary are attributed to a TIN or TIN-NPI according to the following steps:

- For attribution at the TIN level:

- Identify the TIN billing the initial E&M primary care service claim of each candidate event.

- Determine beneficiary months that fall within the risk windows of the candidate events that were initiated by the TIN and overlap the measurement period and attribute those beneficiary months to the TIN.

- For attribution at the TIN-NPI level:

- Identify the TIN-NPI billing the initial E&M primary care service claim of each candidate events.

- Determine beneficiary months that fall within the risk windows of the candidate events that were initiated by the TIN-NPI and that overlap the measurement period.

- Identify the TIN-NPI within an attributed TIN that is responsible for the plurality of candidate events provided to the beneficiary. If two or more TIN-NPIs under a TIN provide the same proportion of candidate events to a beneficiary, attribute the beneficiary to the TIN-NPI that provided the earliest candidate event.

- Attribute only the beneficiary months from candidate events that the TIN-NPI is responsible for initiating, which is not necessarily all candidate events attributed to the TIN for that beneficiary.

All attributed beneficiary months for all beneficiaries are used for the measure calculation for each TIN and TIN-NPI.

Step 4.2: Measure Calculation

This section outlines the following steps in measure calculation:

Step 5: Calculate Payment-Standardized Monthly Observed Costs

Step 6: Risk-Adjust Monthly Costs

Step 7: Specialty Adjust Monthly Costs

Step 8: Calculate the revised TPCC Measure

Step 5: Calculate Payment-Standardized Monthly Observed Costs

Monthly observed cost for attributed beneficiary months is the sum of all service costs billed for a particular beneficiary during a beneficiary month. Monthly observed costs are standardized to account for differences in Medicare payments for the same service(s) across Medicare providers. Payment standardization accounts for differences in Medicare payment unrelated to the care provided, such as those from payment adjustments supporting larger Medicare program goals (e.g. indirect medical education add-on payments) or variation in regional healthcare expenses as measured by hospital wage indexes and geographic price cost indexes (GPCIs). Standardized costs that occur during partially covered months are pro-rated, based on the portion of the month covered by the risk window.

Step 6: Risk-Adjust Monthly Costs

Risk adjustment accounts for beneficiary-level risk factors that can affect medical costs, regardless of the care provided. To ensure that the model measures the influence of health status (as measured by diagnoses) on the treatment provided (costs incurred) rather than capturing the influence of treatment on a beneficiary’s health status, the risk adjustment model uses risk factors from the year prior to a beneficiary month. Separate CMS-HCC models exist for new enrollees, continuing enrollees, enrollees in long-term institutional settings, and enrollees with End-Stage Renal Disease (ESRD).

Risk Adjustment Models

The CMS Hierarchical Condition Category Version 22 (CMS-HCC V22) 2016 Risk Adjustment models are used for beneficiaries without ESRD. Specifically,

- The new enrollee model is used for beneficiaries that have fewer than 12 months of Medicare medical history. The model accounts for each beneficiary’s age, sex, disability status, original reason for Medicare entitlement (age or disability), and Medicaid eligibility.

- The community model is used for beneficiaries that have least 12 months of Medicare medical history. The model includes the same demographic information as the new enrollee model but also accounts for clinical conditions as measured by HCCs.

- The institutional model is used for beneficiaries who were in long-term institutional settings. The model includes demographic variables, clinical conditions as measured by HCCs, and various interaction terms.

The CMS-ESRD Version 21 (CMS-ESRD V21) 2016 Risk Adjustment models are used for ESRD beneficiaries receiving dialysis. Specifically,

- The dialysis new enrollee model is used for ESRD beneficiaries that have fewer than 12 months of Medicare medical history. The model accounts for each beneficiary’s age, sex, disability status, original reason for Medicare entitlement (age or disability), Medicaid eligibility, and ESRD.

- The dialysis community model is used for ESRD beneficiaries that have at least 12 months of Medicare medical history. The model includes the same demographic information as the new enrollee model but also accounts for clinical conditions as measured by HCCs.

The “HCC_Risk_Adjust” tab of the Measure Codes List file lists all variables included in the CMS-ESRD V21 and the CMS-HCC V22 risk adjustment models.

Risk Score Calculation

The CMS-ESRD V21 and CMS-HCC V22 models generate a risk score for each beneficiary that summarizes the beneficiary’s expected cost of care relative to other beneficiaries. Risk scores for ESRD beneficiaries are normalized to be on a comparable scale with the HCC V22 risk scores.

- A risk score equal to 1 indicates risk associated with expenditures for the average beneficiary nationwide.

- A risk score greater than 1 indicates above average risk.

- A risk score less than 1 indicates below average risk.

The risk-adjusted total for each covered month at the TIN or TIN-NPI level is calculated according to the following steps:

- Calculate CMS risk score for each beneficiary month using diagnostic data from the year prior to the month. This risk score is normalized by dividing by the average risk score for all beneficiary months.

- Divide observed costs for each beneficiary month by the normalized risk score to obtain risk-adjusted monthly costs.

- Winsorize risk-adjusted monthly costs at the 99th percentile by assigning the 99th percentile of monthly costs to all attributable beneficiary months with costs above the 99th percentile.

- Normalize monthly costs to account for differences in expected costs based on the number of clinician groups to which a beneficiary is attributed in a given month.

Step 7: Specialty Adjust Monthly Costs

The specialty adjustment for the revised TPCC measure is a cost adjustment applied to account for the fact that costs vary across specialties and across TINs with varying specialty compositions. An example of the specialty adjustment calculation is available in Appendix E. The specialty adjustment at the TIN and TIN-NPI levels is calculated as follows:

- Calculate the average risk-adjusted monthly cost for each TIN and TIN-NPI by averaging risk-adjusted monthly cost across all attributed beneficiary months.

- Calculate the national specialty-specific expected cost for each specialty as the weighted average of TIN/TIN-NPI’s risk-adjusted monthly cost.

- Define the weight for each TIN/TIN-NPI as the percentage of clinicians with that specialty multiplied by the total number of beneficiary months attributed to the TIN/TIN-NPI multiplied by the number of clinicians with that specialty.

- There will only be one specialty designation for a TIN-NPI. Therefore, the percentage of clinicians with a specialty and number of clinicians with a specialty will always be equal to 1.

- Calculate the specialty-adjustment factor for each TIN or TIN-NPI as follows:

- Multiply the national specialty-specific expected cost for each specialty by the respective specialty’s share of Part B payment within a TIN or TIN-NPI.

- Sum the weighted share of national specialty-specific expected cost calculated in the previous step across all the specialties under a given TIN or TIN-NPI.

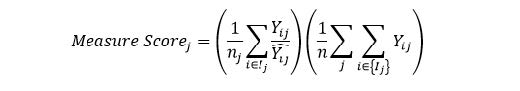

Step 8: Calculate the Revised TPCC Measure Score

Calculate final risk-adjusted, specialty-adjusted cost measure by dividing each TIN and TIN-NPI’s average risk-adjusted monthly cost by their specialty-adjustment factor and multiply this ratio by the average non-risk-adjusted, winsorized observed cost across the total population of attributed beneficiary months.

The clinician-level or clinician group practice-level measure score for any attributed clinician (or clinician group practice) “j” can be represented mathematically as:

where:

| ??? | is the standardized payment for episode i and attributed clinician (or clinician group practice) j |

| ? ?? | is the expected standardized payment for episode i and clinician (or clinician group practice) j, as predicted from risk adjustment |

| ?? | is the number of episodes for clinician (or clinician group practice) j |

| ? | is the total number of TIN/TIN-NPI attributed episodes nationally |

| is all episodes i in the set of episodes attributed to clinician (or clinician group practice) j |

A higher measure score indicates that the observed beneficiary month costs are higher than the expected costs for the care provided by the given specialist for the particular patients and beneficiary months included in the calculation.

Appendix A. Refinements to the Current TPCC Measure

This appendix summarizes differences between the current TPCC measure used in the 2017 MIPS performance period and the revised TPCC measure. The revised measure differs from the MIPS version of the measure in three broad ways. First, the attribution method allows for the attribution of beneficiaries to multiple clinicians and clinician groups. Second, the revised measure only assigns cost after the start of the clinician-patient relationship. Third, the new risk adjustment methodology determines beneficiary’s risk score for each covered month measured using risk factors from the year prior to the covered month.

| Refinement | Current TPCC measure in use for MIPS | Revised TPCC measure |

|---|---|---|

| Attribution | Under the current methodology, beneficiaries are attributed as follows:

|

New attribution method better identifies the existence of a primary care relationship between multiple clinician groups and beneficiaries. Specifically, the attribution method has been refined as follows:

|

| Cost Assignment | The entire annual cost during the measurement period for a beneficiary is assigned to the attributed clinician regardless of when the patient-beneficiary relationship started, in some cases leading to assignment of cost to a clinician prior to ever seeing the beneficiary. | Each attributable event initiates a one-year risk window during which a beneficiary’s costs may be attributable to a clinician. Therefore, cost is only assigned after the clinician has seen the beneficiary. |

| Risk adjustment “lookback” period | Determine beneficiary’s risk score using risk factors from the year prior to measurement period. | Determine beneficiary’s risk score using risk factors for each covered month measured using risk factors from the year prior to each beneficiary month. |

Appendix B. Evaluation and Management Primary Care Services List

Table B below contains a list of select codes that identify evaluation and management (E&M) primary care services.

| CPT / HCPCS Code | CPT/HCPCS Code Description | CPT / HCPCS Code | CPT/HCPCS Code Description |

|---|---|---|---|

| 99201 | New patient office or other outpatient visit, typically 10 minutes | 99327 | New patient assisted living visit, typically 60 minutes |

| 99202 | New patient office or other outpatient visit, typically 20 minutes | 99328 | New patient assisted living visit, typically 75 minutes |

| 99203 | New patient office or other outpatient visit, typically 30 minutes | 99334 | Established patient assisted living visit, typically 15 minutes |

| 99204 | New patient office or other outpatient visit, typically 45 minutes | 99335 | Established patient assisted living visit, typically 25 minutes |

| 99205 | New patient office or other outpatient visit, typically 60 minutes | 99336 | Established patient assisted living visit, typically 40 minutes |

| 99211 | Established patient office or other outpatient visit, typically 5 minutes | 99337 | Established patient assisted living visit, typically 60 minutes |

| 99212 | Established patient office or other outpatient visit, typically 10 minutes | 99339 | Physician supervision of patient care at home or assisted living facility, 15-29 minutes in one month |

| 99213 | Established patient office or other outpatient visit, typically 15 minutes | 99340 | Physician supervision of patient care at home or assisted living facility, 30 minutes or more in one month |

| 99214 | Established patient office or other outpatient, visit typically 25 minutes | 99341 | New patient home visit, typically 20 minutes |

| 99215 | Established patient office or other outpatient, visit typically 40 minutes | 99342 | New patient home visit, typically 30 minutes |

| 99304 | Initial nursing facility visit, typically 25 minutes per day | 99343 | New patient home visit, typically 45 minutes |

| 99305 | Initial nursing facility visit, typically 35 minutes per day | 99344 | New patient home visit, typically 60 minutes |

| 99306 | Initial nursing facility visit, typically 45 minutes per day | 99345 | New patient home visit, typically 75 minutes |

| 99307 | Subsequent nursing facility visit, typically 10 minutes per day | 99347 | Established patient home visit, typically 15 minutes |

| 99308 | Subsequent nursing facility visit, typically 15 minutes per day | 99348 | Established patient home visit, typically 25 minutes |

| 99309 | Subsequent nursing facility visit, typically 25 minutes per day | 99349 | Established patient home visit, typically 40 minutes |

| 99310 | Subsequent nursing facility visit, typically 35 minutes per day | 99350 | Established patient home visit, typically 60 minutes |

| 99315 | Nursing facility discharge day management, 30 minutes or less | 99490 | Chronic care management services at least 20 minutes per calendar month |

| 99316 | Nursing facility discharge management, more than 30 minutes | 99495 | Transitional care management services, moderately complexity, requiring face-to-face visits within 14 days of discharge |

| 99318 | Nursing facility annual assessment, typically 30 minutes | 99496 | Transitional care management services, highly complexity, requiring face-to-face visits within 7 days of discharge |

| 99324 | New patient assisted living visit, typically 20 minutes | G0402 | Initial preventive physical examination; face-to-face visit, services limited to new beneficiary during the first 12 months of Medicare enrollment |

| 99325 | New patient assisted living visit, typically 30 minutes | G0438 | Annual wellness visit; includes a personalized prevention plan of service (pps), initial visit |

| 99326 | New patient assisted living visit, typically 45 minutes | G0439 | Annual wellness visit, includes a personalized prevention plan of service (pps), subsequent visit |

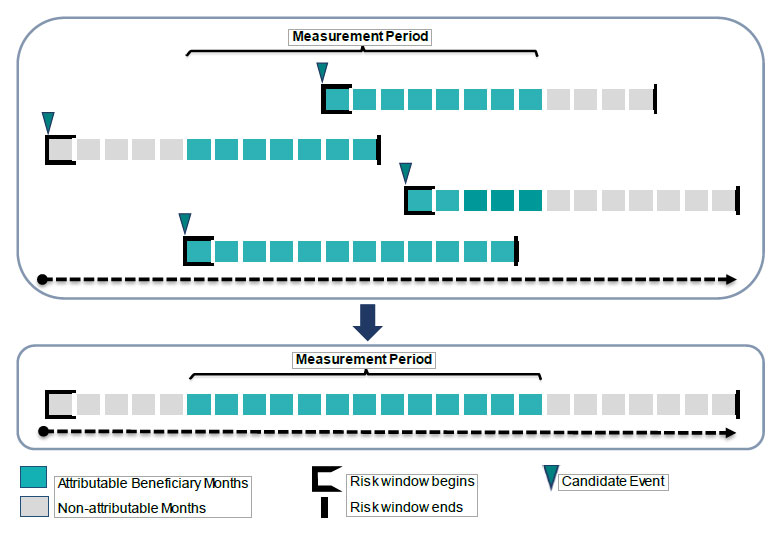

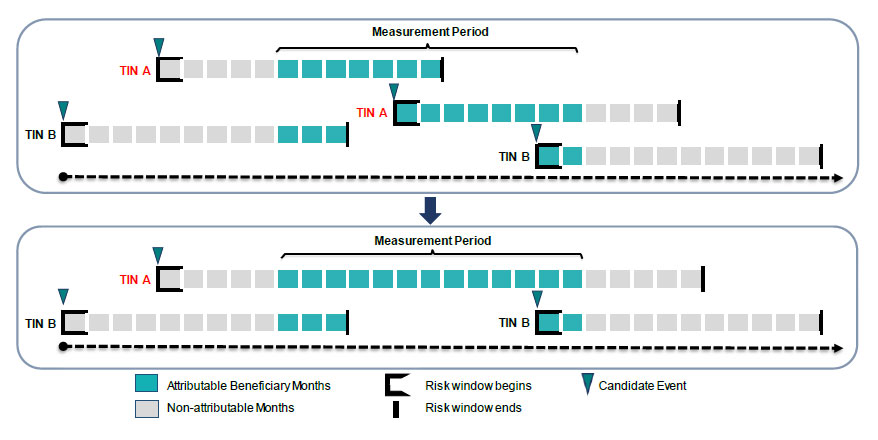

Appendix C. Illustration of Overlapping Risk Windows Triggered by a TIN for the Same Beneficiary

Due to the nature of primary care, it is possible for multiple risk windows to be initiated if one or several TINs see the patient multiple times during the year. This appendix provides further information on how potentially attributable beneficiary months are determined when the patient is seen by the TIN(s) multiple times before or during the measurement period.

Overlapping Risk Windows Initiated by One TIN for the Same Beneficiary

Figure C-1 below provides an example of the interactions of multiple risk windows initiated by the same TIN for one beneficiary.

The first part of the diagram shows multiple candidate events between a TIN and a beneficiary that trigger the opening of overlapping risk windows. For each risk window, the months that overlap with the measurement period are attributable (indicated by a teal fill). The second part of the diagram shows the resulting collapsed months for which the TIN will be held accountable. In this example, all 13 beneficiary months in the measurement period will be attributed to the TIN because together, the five risk windows cover the entirety of the measurement period. Provided that the TIN-NPIs responsible for any of these candidate events do not meet the service category or specialty exclusions, the costs assigned to these 13 beneficiary months for this beneficiary will be attributed to the TIN.

Overlapping Risk Windows Initiated by Multiple TINs for the Same Beneficiary

Figure C-2 below shows the interactions of multiple risk windows initiated by multiple TINs for one beneficiary, illustrating multiple attribution.

The top part of the diagram shows multiple candidate events, each triggering the opening of a risk window. For each risk window, the months that overlap with the measurement period are attributable and are represented by teal rectangles. The bottom part of the diagram shows how the beneficiary months will get attributed to different TINs, depending on the risk windows that they triggered.

In the example illustrated in figure C-2, all 13 beneficiary months in the measurement period are attributable because together, the four risk windows cover the entirety of the measurement period. Since different TINs initiated the risk windows, the beneficiary months will be attributed to the corresponding TINs in the following manner:

- TIN A initiated two overlapping risk windows for the beneficiary.

- Together these two risk windows overlap with each of the 13 beneficiary months in the measurement period and, therefore, all of these 13 beneficiary months will be attributed to TIN A.

- TIN B initiated two non-overlapping risk windows that partially overlap with the measurement period.

- Three beneficiary months from the first risk window and two beneficiary months from the second risk window overlapping the measurement period will get attributed to TIN B.

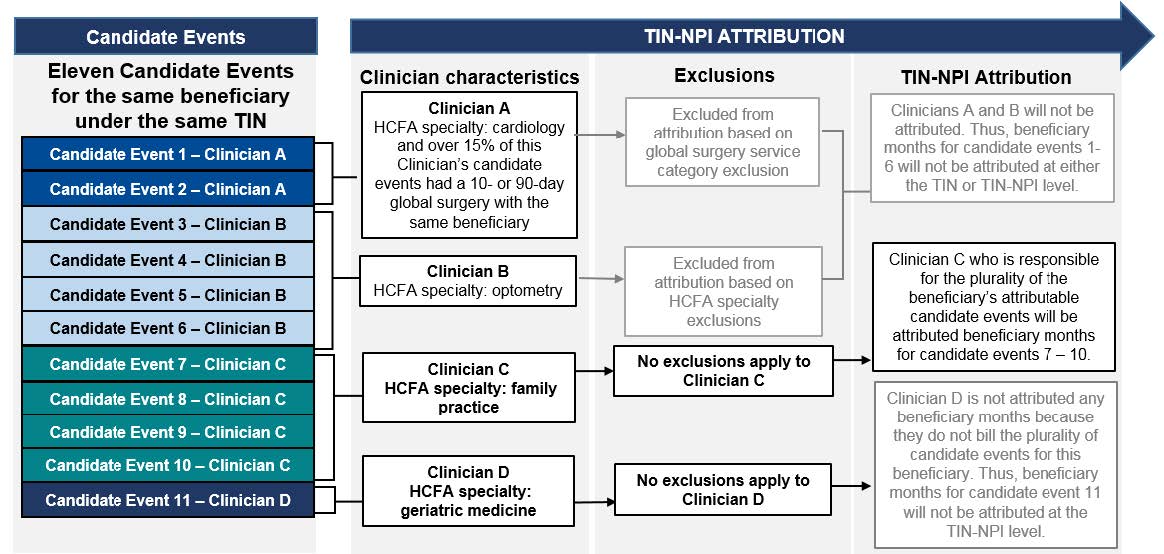

Appendix D. Illustration of Attribution of Beneficiary Months for the Revised TPCC Measure

This appendix provides further details and examples of attribution for the revised TPCC measure beneficiary months.

In the example shown above, the stacked, colored boxes on the left represent 11 candidate events billed by four different clinicians (clinician A through D) practicing under the same TIN. The next set of boxes to the right of the colored boxes shows the specialties for each clinician and/or whether they billed any of the services that are part of the service category exclusions at the threshold needed to qualify for exclusion (10-day and 90-day global surgery, anesthesia, chemotherapy, and therapeutic radiation). The set of boxes to the far right shows which clinicians are excluded from attribution based on service category and/or specialty exclusions and which clinicians are included.

- Clinician A billed over 15% of 10-day or 90-day global surgery codes to his beneficiaries,

- Clinician A is excluded from attribution based on the global surgery service category exclusion, and

- Candidate events 1 and 2 are removed from both the TIN and TIN-NPI’s measure calculation.

- Clinician B had an optometry HCFA specialty

- Clinician B has a HCFA specialty that is included in the list of 56 specialties that are excluded from attribution, and

- Candidate events 3 through 6 are removed from both the TIN and TIN-NPI’s measure calculation.

- Clinician C did not meet any of the service category exclusions and had a HCFA specialty for family practice which is not one of the 56 specialties excluded from the revised TPCC measure.

- Clinician C is attributed beneficiary months overlapping the measurement period and the risk windows initiated by candidate events 7 through 10.

- The resulting beneficiary months are included in both the TIN and TIN-NPI’s measure calculation.

- Clinician D did not meet any of the service category exclusions and had a HCFA specialty for geriatric medicine which is not one of the 56 specialties excluded from the revised TPCC measure.

- Clinician D was not attributed any beneficiary months because they did not bill the plurality of candidate events for this beneficiary within the TIN.

- Candidate event 11 will not be attributed at the TIN-NPI level, but will be attributed at the TIN level.

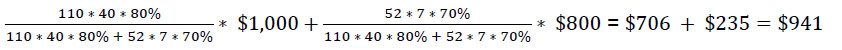

Appendix E. Example of Specialty Adjustment

This appendix provides some further details and example of specialty adjustment. In this example numbers have been rounded to the nearest whole integer for simplicity. When calculating the measure for performance, no such rounding will occur.

- Suppose the entire population consists of two TINs (TIN A and TIN B) with two types of specialists under them, Family Practice and Internal Medicine. Table B below provides some additional information on the TINs’ characteristics:

- Calculate the national specialty-specific expected cost for each specialty

- Calculate the national Internal Medicine expected cost as follows:

- Calculate the national Family Practice expected cost as follows:

- Calculate the national Internal Medicine expected cost as follows:

- Calculate the specialty-adjustment factor for TIN A and TIN B as the weighted average of the national specialty-specific expected costs. The weight is the TIN’s percent of Part B Physician/Supplier payments for that specialty.

- TIN A’s specialty-adjustment factor is calculated as follows:

($826 * 10%) + ($941 * 90%) = $924 - TIN B’s specialty-adjustment factor is calculated as follows:

($826 * 50%) + ($941 * 50%) = $884

- TIN A’s specialty-adjustment factor is calculated as follows:

- For each TIN, calculate the TPCC measure score (assuming the national average cost is $900):

- TIN A’s measure score is calculated as follows:

(($1,000 / $924) * $900 = $974 - TIN B’s measure score is calculated as follows:

(($800 / $884) * $900) = $814

- TIN A’s measure score is calculated as follows: